Perspectives

….. to spark discussions ….

Investing With Purpose : "How to" of Values Aligned Investing

For many individuals, investing is not only about achieving financial returns but also about owning companies that align with their values. Values-aligned investing, also known as socially responsible investing, allows individuals to align their investment decisions with their personal beliefs and values.

So where does one start? First, take the time to identify the causes and principles that matter most to you. Whether it’s environmental causes, social justice, or ethical business practices, understanding your values is crucial in guiding your choices.

Like everything in life, in investments, there is no absolute good or bad. Researching investment options that align with your beliefs is key for those who would like to embark on the journey. Evaluate the investment opportunity based on both its alignment with your values and its potential for financial returns. And over time, monitor and adjust your investments regularly to ensure they continue to align with your values and financial goals.

As you understand developments in the companies you invest in, be prepared to adjust your investments as needed. By following these steps, you can begin the process of integrating your values into your investment strategies while pursuing financial growth.

Tethered to Trash: Humanity's Connection to Waste

In the modern era, our relentless pursuit of convenience has led to a pressing issue of waste management. From the widespread use of single-use plastics to the continuous cycle of disposable electronics, our daily routines contribute to a complex web of discard. Each discarded item symbolizes our collective oversight, resulting in the rapid expansion of landfills, the degradation of oceans, and a significant toll on wildlife.

Despite this looming crisis, the real challenge lies not just in recognizing the issue but in actively addressing it. Our reliance on convenience, coupled with systemic structures that support our ways of life, perpetuates an unsustainable path. Even as we witness the environmental consequences, breaking free from this cycle can often seem like an insurmountable task.

In the artwork by Raquel Fornasaro, aptly titled “Tether,” we are confronted with a visual representation of how humans are intricately chained to the trash we create. The globe in the sculpture below is created from plastic trash, and the attached chain showcases human linkage to the trash generated.

The visuals serve as a stark reminder of how our daily choices impact the environment. Escaping this cycle isn’t just about personal decisions; the current setup perpetuates our reliance on throwaway products, making it tough to shift gears. A systemic mindset is crucial for driving the necessary transformations. It means reimagining how we produce and consume, embedding sustainability into every aspect of society. Whether it’s rethinking packaging or improving recycling, systemic shifts can pave the way for a circular economy—a model that minimizes waste, preserves resources, and lessens our environmental footprint.

Embracing this comprehensive approach enables us to break free from the chains of waste and chart a course toward a more sustainable tomorrow. It requires cooperation, innovation, and a collective dedication to enacting substantive change across all levels of society.

Global Events vs. Local Consumption: Uncovering the Link

𝗙𝘂𝗻 𝗧𝗿𝗶𝘃𝗶𝗮: 𝗛𝗼𝘄 𝗜𝘀 𝘆𝗼𝘂𝗿 𝗰𝗼𝗼𝗸𝘄𝗮𝗿𝗲 𝗿𝗲𝗹𝗮𝘁𝗲𝗱 𝘁𝗼 𝗴𝗹𝗼𝗯𝗮𝗹 𝘁𝗿𝗮𝗱𝗲 𝗱𝘆𝗻𝗮𝗺𝗶𝗰𝘀? Often times, events occurring beyond national borders might seem unrelated to local interests at first glance. However, delving deeper into specific incidents allows us to uncover the connections. Take, for example, the global iron ore market. Iron ore plays a vital role in steel production, which is essential in everything from common utensils, infrastructure, transportation systems, to machinery. Australia and Brazil, as major suppliers, account for over 70% of the world’s seaborne iron ore trade. Steel is the backbone of various industries that shape the foundation of modern society and its economic well-being.

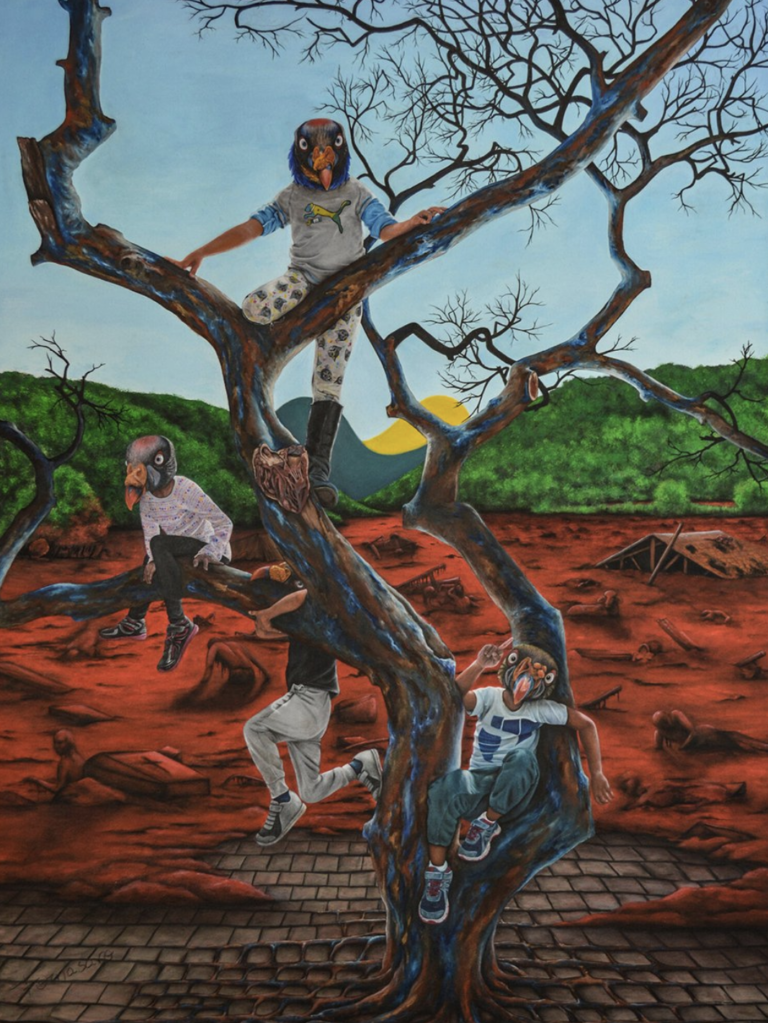

The evocative artwork “Brumadinho,” crafted by artist Fornasaro, powerfully portrays the aftermath of a devastating iron-ore mining incident in 2019. It serves as a poignant outcry from the artist, condemning negligence of safety practices while also illustrating the complex interplay between local consumption patterns and global events.

The linkage to consumption becomes increasingly evident when we trace the pathway from demand to extraction and subsequent environmental impacts. This realization underscores the interconnectedness of global supply chains and local communities, emphasizing the need for a comprehensive approach to address these issues. Often times, disasters become distant memories over time. However, the convergence of avenues like the arts and science can play a pivotal role in broadening the reach of information to a wider audience, and helping to keep memories of these calamities alive in collective consciousness. This depiction showcases the inherent dangers of mining practices and issues arising from the storage of waste in tailings dams.

With the shadow of a class-action lawsuit looming over the tragic Samarco tailings mine failure (2015), the need for transparency and accountability in mining practices echoes more urgently than ever.

A Symbiotic Relationship Between Profitability & Sustainability

Is financial success is essential for a company to scale its impact? Our guiding principle is straightforward: for solutions to be truly scalable, financial stability is non-negotiable. While sustainability often conjures images of environmental responsibility and ethical commitment, that without a firm financial foundation, even the noblest endeavors can falter. Hence, we actively seek out organizations that exist at the crossroads of financial viability and sustainable solutions.

Here’s why our approach is relevant:

- Longevity and Resilience: Financially successful companies can withstand economic uncertainties and unforeseen challenges. This resilience ensures the uninterrupted continuity of their initiatives over the long haul.

- Scalability: To make a meaningful impact, solutions must reach a broader audience. Financial stability empowers companies to expand their operations, bringing products and practices to more people and markets.

- Innovation: Advancing sustainability often demands innovative thinking and substantial investments in research and development. Financially robust companies can allocate resources for these endeavors, propelling progress in sustainable technology and practices.

- Partnerships and Collaboration: Financially stable companies can engage in strategic collaborations with like-minded entities, government bodies, and NGOs, amplifying their impact and accelerating progress toward shared goals.

By investing in companies that strike a harmonious balance between these two facets, we aim to invest with firms leading in sustainable solutions that are financially viable.