Investment & Non-Profit Perspectives

Helping clients in efficiently managing their assets. Contact us to learn more.

What Does It Mean When the FED Cuts Interest Rates?

𝙒𝙝𝙚𝙣 𝙩𝙝𝙚 𝙁𝙚𝙙𝙚𝙧𝙖𝙡 𝙍𝙚𝙨𝙚𝙧𝙫𝙚 (𝙁𝙚𝙙) 𝙙𝙚𝙘𝙞𝙙𝙚𝙨 𝙩𝙤 𝙘𝙪𝙩 𝙞𝙣𝙩𝙚𝙧𝙚𝙨𝙩 𝙧𝙖𝙩𝙚𝙨, 𝙞𝙩 𝙤𝙛𝙩𝙚𝙣 𝙨𝙥𝙖𝙧𝙠𝙨 𝙖 𝙡𝙤𝙩 𝙤𝙛 𝙚𝙭𝙘𝙞𝙩𝙚𝙢𝙚𝙣𝙩 𝙖𝙣𝙙 𝙨𝙥𝙚𝙘𝙪𝙡𝙖𝙩𝙞𝙤𝙣 𝙞𝙣 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙢𝙖𝙧𝙠𝙚𝙩𝙨. 𝘽𝙪𝙩 𝙬𝙝𝙖𝙩 𝙚𝙭𝙖𝙘𝙩𝙡𝙮 𝙙𝙤𝙚𝙨 𝙩𝙝𝙞𝙨 𝙢𝙤𝙫𝙚 𝙨𝙞𝙜𝙣𝙞𝙛𝙮, 𝙖𝙣𝙙 𝙬𝙝𝙖𝙩 𝙖𝙧𝙚 𝙞𝙩𝙨 𝙥𝙤𝙩𝙚𝙣𝙩𝙞𝙖𝙡 𝙞𝙢𝙥𝙡𝙞𝙘𝙖𝙩𝙞𝙤𝙣𝙨?

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 𝗮 𝗥𝗮𝘁𝗲 𝗖𝘂𝘁 𝗶𝗻 𝘁𝗵𝗲 𝗖𝗼𝗻𝘁𝗲𝘅𝘁 𝗼𝗳 𝘁𝗵𝗲 𝗖𝘂𝗿𝗿𝗲𝗻𝘁 𝗘𝗻𝘃𝗶𝗿𝗼𝗻𝗺𝗲𝗻𝘁

One of the primary reasons the Fed might change interest rates is to respond to inflationary pressures. After a bout of inflation, when prices have risen substantially over a period, a rate cut could indicate that inflation has begun to slow down. However, the context in which the Fed makes such a decision is critical to understanding its true impact. Interest rates play a vital role in the economy by influencing borrowing costs for consumers and businesses. Lower interest rates make it cheaper to borrow money, which can lead to more spending and investment. In a healthy economy, this can spur growth. But if the economy is already showing signs of slowing, a rate cut might be a way to prevent it from falling into a recession.

𝗧𝗵𝗲 𝗕𝗮𝗹𝗮𝗻𝗰𝗶𝗻𝗴 𝗔𝗰𝘁: 𝗜𝘀 𝘁𝗵𝗲 𝗡𝗲𝘅𝘁 𝗦𝘁𝗮𝗴𝗲 𝗮 𝗥𝗲-𝗮𝗰𝗰𝗲𝗹𝗲𝗿𝗮𝘁𝗶𝗼𝗻 𝗼𝗿 𝗥𝗲𝗰𝗲𝘀𝘀𝗶𝗼𝗻?

The big question with any rate cut is whether it will provide just enough of a boost to keep the economy growing or if it might be a signal of more significant troubles ahead. If the economy is already on a downward trend, a rate cut might not be enough to turn things around and could foreshadow a recession. On the other hand, if the cut is just the right nudge, it could help reignite growth and set the stage for a period of economic expansion.

The real challenge is that it’s nearly impossible to time the market or predict how the economy will react. Rate cuts can create short-term market movements, but the long-term effects depend on a complex interplay of factors like consumer behavior, business investment, and global economic trends.

𝗧𝗵𝗲 𝗟𝗼𝗻𝗴-𝗧𝗲𝗿𝗺 𝗔𝗽𝗽𝗿𝗼𝗮𝗰𝗵: 𝗙𝗼𝗰𝘂𝘀 𝗼𝗻 𝗤𝘂𝗮𝗹𝗶𝘁𝘆 𝗮𝗻𝗱 𝗩𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻

For investors, trying to “time” these events can be risky. Instead, focusing on owning high-quality businesses at reasonable valuations can be a more effective strategy. These assets often have strong balance sheets, sustainable business models, and the potential for long-term growth. By investing in such businesses, you can compound wealth over the long run, capturing the upside of market gains while protecting yourself on the downside during periods of economic uncertainty.

In essence, while interest rate cuts can provide a temporary boost to markets and economies, the key to building lasting wealth lies in a disciplined, long-term approach—one that emphasizes quality and attractive valuations, regardless of short-term fluctuations.

What Are Liquid Alts ?

𝗟𝗶𝗾𝘂𝗶𝗱 𝗮𝗹𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝘃𝗲 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗲𝘀 𝗼𝗳𝘁𝗲𝗻 𝗰𝗼𝗺𝗲 𝘂𝗽 𝗶𝗻 𝗱𝗶𝘀𝗰𝘂𝘀𝘀𝗶𝗼𝗻𝘀 𝗮𝗺𝗼𝗻𝗴 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀, 𝗲𝘀𝗽𝗲𝗰𝗶𝗮𝗹𝗹𝘆 𝗴𝗶𝘃𝗲𝗻 𝘁𝗵𝗲𝘆 𝗰𝗮𝗻 𝗻𝗼𝘄 𝗯𝗲 𝗮𝗰𝗰𝗲𝘀𝘀𝗲𝗱 𝘃𝗶𝗮 𝗽𝘂𝗯𝗹𝗶𝗰𝗹𝘆 𝘁𝗿𝗮𝗱𝗲𝗱 𝗘𝗧𝗙’𝘀. 𝗦𝗼, 𝘄𝗵𝗮𝘁 𝗲𝘅𝗮𝗰𝘁𝗹𝘆 𝗮𝗿𝗲 𝘁𝗵𝗲𝘆, 𝗮𝗻𝗱 𝘄𝗵𝗮𝘁 𝗶𝘀 𝘁𝗵𝗲𝗶𝗿 𝗿𝗼𝗹𝗲 𝗶𝗻 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼𝘀?

𝙻𝚎𝚝’𝚜 𝚜𝚝𝚊𝚛𝚝 𝚠𝚒𝚝𝚑 𝚜𝚘𝚖𝚎𝚝𝚑𝚒𝚗𝚐 𝚏𝚊𝚖𝚒𝚕𝚒𝚊𝚛: 𝚝𝚑𝚎 𝟼𝟶/𝟺𝟶 𝚙𝚘𝚛𝚝𝚏𝚘𝚕𝚒𝚘—𝚊 𝚖𝚒𝚡 𝚘𝚏 𝟼𝟶% 𝚜𝚝𝚘𝚌𝚔𝚜 𝚊𝚗𝚍 𝟺𝟶% 𝚋𝚘𝚗𝚍𝚜. 𝙵𝚘𝚛 𝚢𝚎𝚊𝚛𝚜, 𝚝𝚘𝚞𝚝𝚎𝚍 𝚊𝚜 𝚊 𝚛𝚎𝚕𝚒𝚊𝚋𝚕𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚏𝚘𝚛 𝚋𝚊𝚕𝚊𝚗𝚌𝚒𝚗𝚐 𝚛𝚒𝚜𝚔 𝚊𝚗𝚍 𝚛𝚎𝚝𝚞𝚛𝚗.

𝙱𝚞𝚝 𝚑𝚎𝚛𝚎’𝚜 𝚝𝚑𝚎 𝚙𝚛𝚘𝚋𝚕𝚎𝚖: 𝚠𝚑𝚎𝚗 𝚖𝚊𝚛𝚔𝚎𝚝𝚜 𝚌𝚛𝚊𝚜𝚑, 𝚝𝚑𝚎 𝚊𝚟𝚎𝚛𝚊𝚐𝚎 𝚒𝚗𝚟𝚎𝚜𝚝𝚘𝚛 𝚏𝚊𝚌𝚎𝚜 𝚊 𝚐𝚞𝚝-𝚠𝚛𝚎𝚗𝚌𝚑𝚒𝚗𝚐 𝚍𝚒𝚕𝚎𝚖𝚖𝚊. 𝚆𝚑𝚎𝚗 𝚢𝚘𝚞 𝚠𝚊𝚝𝚌𝚑 𝚢𝚘𝚞𝚛 𝚙𝚘𝚛𝚝𝚏𝚘𝚕𝚒𝚘 𝚍𝚛𝚘𝚙, 𝚒𝚝’𝚜 𝚑𝚞𝚖𝚊𝚗 𝚗𝚊𝚝𝚞𝚛𝚎 𝚝𝚘 𝚙𝚊𝚗𝚒𝚌, 𝚊𝚗𝚍 𝚒𝚝 𝚝𝚊𝚔𝚎𝚜 𝚊𝚗 𝚊𝚕𝚖𝚘𝚜𝚝 𝚜𝚞𝚙𝚎𝚛𝚑𝚞𝚖𝚊𝚗 𝚎𝚏𝚏𝚘𝚛𝚝 𝚗𝚘𝚝 𝚝𝚘 𝚙𝚞𝚕𝚕 𝚢𝚘𝚞𝚛 𝚖𝚘𝚗𝚎𝚢 𝚘𝚞𝚝. 𝚃𝚑𝚒𝚜 𝚋𝚛𝚒𝚗𝚐𝚜 𝚞𝚙 𝚝𝚑𝚎 𝚒𝚍𝚎𝚊 𝚘𝚏 “𝚍𝚘𝚠𝚗𝚜𝚒𝚍𝚎-𝚙𝚛𝚘𝚝𝚎𝚌𝚝𝚎𝚍 𝚛𝚎𝚝𝚞𝚛𝚗𝚜,” 𝚘𝚛 𝚒𝚗𝚟𝚎𝚜𝚝𝚖𝚎𝚗𝚝𝚜 𝚝𝚑𝚊𝚝 𝚊𝚒𝚖 𝚝𝚘 𝚐𝚛𝚘𝚠 𝚠𝚑𝚒𝚕𝚎 𝚜𝚘𝚏𝚝𝚎𝚗𝚒𝚗𝚐 𝚝𝚑𝚎 𝚋𝚕𝚘𝚠 𝚍𝚞𝚛𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚘𝚠𝚗𝚝𝚞𝚛𝚗𝚜. 𝙰𝚖𝚘𝚗𝚐 𝚝𝚑𝚎 𝚘𝚙𝚝𝚒𝚘𝚗𝚜, 𝚝𝚑𝚛𝚎𝚎 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑𝚎𝚜—𝚁𝚒𝚜𝚔 𝙿𝚊𝚛𝚒𝚝𝚢, 𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎 𝚁𝚒𝚜𝚔 𝙿𝚛𝚎𝚖𝚒𝚊 (𝙰𝚁𝙿), 𝚊𝚗𝚍 𝙼𝚊𝚗𝚊𝚐𝚎𝚍 𝙵𝚞𝚝𝚞𝚛𝚎𝚜—𝚜𝚝𝚊𝚗𝚍 𝚘𝚞𝚝, 𝚠𝚒𝚝𝚑 𝚙𝚞𝚋𝚕𝚒𝚌𝚕𝚢 𝚝𝚛𝚊𝚍𝚎𝚍 𝚒𝚗𝚜𝚝𝚛𝚞𝚖𝚎𝚗𝚝𝚜 𝚊𝚟𝚊𝚒𝚕𝚊𝚋𝚕𝚎.

𝚁𝚒𝚜𝚔 𝙿𝚊𝚛𝚒𝚝𝚢, 𝚊𝚝 𝚒𝚝𝚜 𝚌𝚘𝚛𝚎, 𝚊𝚝𝚝𝚎𝚖𝚙𝚝𝚜 𝚝𝚘 𝚕𝚎𝚟𝚎𝚕 𝚝𝚑𝚎 𝚙𝚕𝚊𝚢𝚒𝚗𝚐 𝚏𝚒𝚎𝚕𝚍 𝚋𝚢 𝚋𝚊𝚕𝚊𝚗𝚌𝚒𝚗𝚐 𝚛𝚒𝚜𝚔 𝚌𝚘𝚗𝚝𝚛𝚒𝚋𝚞𝚝𝚒𝚘𝚗𝚜 𝚊𝚌𝚛𝚘𝚜𝚜 𝚊𝚜𝚜𝚎𝚝 𝚌𝚕𝚊𝚜𝚜𝚎𝚜 𝚕𝚒𝚔𝚎 𝚜𝚝𝚘𝚌𝚔𝚜, 𝚋𝚘𝚗𝚍𝚜, 𝚊𝚗𝚍 𝚌𝚘𝚖𝚖𝚘𝚍𝚒𝚝𝚒𝚎𝚜. 𝚆𝚑𝚊𝚝 𝚍𝚘𝚎𝚜 𝚝𝚑𝚊𝚝 𝚖𝚎𝚊𝚗? 𝙸𝚝 𝚝𝚛𝚒𝚎𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚝𝚑𝚎 𝚛𝚒𝚜𝚔 𝚘𝚏 𝚝𝚢𝚙𝚒𝚌𝚊𝚕𝚕𝚢 𝚕𝚎𝚜𝚜 𝚟𝚘𝚕𝚊𝚝𝚒𝚕𝚎 𝚊𝚜𝚜𝚎𝚝𝚜, 𝚕𝚒𝚔𝚎 𝚋𝚘𝚗𝚍𝚜, 𝚌𝚘𝚖𝚙𝚊𝚛𝚊𝚋𝚕𝚎 𝚝𝚘 𝚝𝚑𝚊𝚝 𝚘𝚏 𝚖𝚘𝚛𝚎 𝚍𝚢𝚗𝚊𝚖𝚒𝚌 𝚘𝚗𝚎𝚜, 𝚕𝚒𝚔𝚎 𝚎𝚚𝚞𝚒𝚝𝚒𝚎𝚜. 𝚃𝚑𝚒𝚜 𝚌𝚛𝚎𝚊𝚝𝚎𝚜 𝚊 𝚖𝚘𝚛𝚎 𝚌𝚘𝚗𝚜𝚒𝚜𝚝𝚎𝚗𝚝 𝚙𝚎𝚛𝚏𝚘𝚛𝚖𝚊𝚗𝚌𝚎 𝚘𝚟𝚎𝚛 𝚝𝚒𝚖𝚎. 𝙱𝚞𝚝 𝚝𝚑𝚎𝚛𝚎’𝚜 𝚊 𝚌𝚊𝚝𝚌𝚑: 𝚛𝚎𝚍𝚞𝚌𝚒𝚗𝚐 𝚛𝚒𝚜𝚔 𝚘𝚏𝚝𝚎𝚗 𝚖𝚎𝚊𝚗𝚜 𝚕𝚘𝚠𝚎𝚛 𝚛𝚎𝚝𝚞𝚛𝚗𝚜. 𝚃𝚑𝚊𝚝’𝚜 𝚠𝚑𝚎𝚛𝚎 𝚕𝚎𝚟𝚎𝚛𝚊𝚐𝚎 𝚌𝚘𝚖𝚎𝚜 𝚒𝚗. 𝚃𝚑𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚊𝚝𝚝𝚎𝚖𝚙𝚝𝚜 𝚝𝚘 𝚕𝚎𝚟𝚎𝚛 𝚞𝚙 𝚕𝚘𝚠 𝚟𝚘𝚕 𝚛𝚎𝚝𝚞𝚛𝚗𝚜, 𝚊𝚗𝚍 𝚝𝚑𝚞𝚜 𝚎𝚚𝚞𝚊𝚕𝚒𝚣𝚎 𝚛𝚒𝚜𝚔 𝚋𝚎𝚝𝚠𝚎𝚎𝚗 𝚘𝚠𝚗𝚎𝚍 𝚊𝚜𝚜𝚎𝚝𝚜.

𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎 𝚁𝚒𝚜𝚔 𝙿𝚛𝚎𝚖𝚒𝚊, 𝚘𝚛 𝙰𝚁𝙿, 𝚏𝚘𝚌𝚞𝚜𝚎𝚜 𝚘𝚗 𝚌𝚊𝚙𝚝𝚞𝚛𝚒𝚗𝚐 𝚗𝚘𝚗-𝚝𝚛𝚊𝚍𝚒𝚝𝚒𝚘𝚗𝚊𝚕 𝚜𝚘𝚞𝚛𝚌𝚎𝚜 𝚘𝚏 𝚛𝚎𝚝𝚞𝚛𝚗 𝚋𝚢 𝚎𝚡𝚙𝚕𝚘𝚒𝚝𝚒𝚗𝚐 𝚙𝚊𝚝𝚝𝚎𝚛𝚗𝚜 𝚊𝚗𝚍 𝚒𝚗𝚎𝚏𝚏𝚒𝚌𝚒𝚎𝚗𝚌𝚒𝚎𝚜 𝚒𝚗 𝚖𝚊𝚛𝚔𝚎𝚝𝚜. 𝚃𝚑𝚎𝚜𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚒𝚎𝚜 𝚘𝚏𝚝𝚎𝚗 𝚛𝚎𝚕𝚢 𝚘𝚗 𝚕𝚘𝚗𝚐-𝚜𝚑𝚘𝚛𝚝 𝚝𝚎𝚌𝚑𝚗𝚒𝚚𝚞𝚎𝚜, 𝚋𝚊𝚕𝚊𝚗𝚌𝚒𝚗𝚐 𝚋𝚎𝚝𝚜 𝚘𝚗 𝚊𝚜𝚜𝚎𝚝𝚜 𝚎𝚡𝚙𝚎𝚌𝚝𝚎𝚍 𝚝𝚘 𝚛𝚒𝚜𝚎 𝚊𝚐𝚊𝚒𝚗𝚜𝚝 𝚝𝚑𝚘𝚜𝚎 𝚎𝚡𝚙𝚎𝚌𝚝𝚎𝚍 𝚝𝚘 𝚏𝚊𝚕𝚕. 𝚆𝚑𝚒𝚕𝚎 𝚕𝚎𝚟𝚎𝚛𝚊𝚐𝚎 𝚒𝚜𝚗’𝚝 𝚝𝚑𝚎 𝚙𝚛𝚒𝚖𝚊𝚛𝚢 𝚏𝚘𝚌𝚞𝚜, 𝚒𝚝 𝚌𝚊𝚗 𝚋𝚎 𝚞𝚜𝚎𝚍 𝚜𝚙𝚊𝚛𝚒𝚗𝚐𝚕𝚢 𝚝𝚘 𝚎𝚗𝚑𝚊𝚗𝚌𝚎 𝚎𝚡𝚙𝚘𝚜𝚞𝚛𝚎 𝚝𝚘 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚘𝚙𝚙𝚘𝚛𝚝𝚞𝚗𝚒𝚝𝚒𝚎𝚜. 𝚂𝚘, 𝚠𝚑𝚊𝚝 𝚊𝚛𝚎 𝚝𝚑𝚎𝚜𝚎 𝚎𝚕𝚞𝚜𝚒𝚟𝚎 𝚏𝚊𝚌𝚝𝚘𝚛𝚜? 𝙼𝚘𝚖𝚎𝚗𝚝𝚞𝚖 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚋𝚎𝚝𝚝𝚒𝚗𝚐 𝚘𝚗 𝚊𝚜𝚜𝚎𝚝𝚜 𝚠𝚒𝚝𝚑 𝚜𝚝𝚛𝚘𝚗𝚐 𝚙𝚛𝚒𝚌𝚎 𝚝𝚛𝚎𝚗𝚍𝚜—𝚝𝚑𝚘𝚜𝚎 𝚝𝚑𝚊𝚝 𝚊𝚛𝚎 𝚛𝚒𝚜𝚒𝚗𝚐 𝚝𝚎𝚗𝚍 𝚝𝚘 𝚔𝚎𝚎𝚙 𝚛𝚒𝚜𝚒𝚗𝚐, 𝚊𝚗𝚍 𝚝𝚑𝚘𝚜𝚎 𝚏𝚊𝚕𝚕𝚒𝚗𝚐 𝚝𝚎𝚗𝚍 𝚝𝚘 𝚔𝚎𝚎𝚙 𝚏𝚊𝚕𝚕𝚒𝚗𝚐. 𝙲𝚊𝚛𝚛𝚢 𝚝𝚊𝚛𝚐𝚎𝚝𝚜 𝚊𝚜𝚜𝚎𝚝𝚜 𝚠𝚒𝚝𝚑 𝚑𝚒𝚐𝚑𝚎𝚛 𝚢𝚒𝚎𝚕𝚍𝚜 𝚛𝚎𝚕𝚊𝚝𝚒𝚟𝚎 𝚝𝚘 𝚝𝚑𝚎𝚒𝚛 𝚌𝚘𝚜𝚝, 𝚜𝚞𝚌𝚑 𝚊𝚜 𝚑𝚒𝚐𝚑𝚎𝚛 𝚒𝚗𝚝𝚎𝚛𝚎𝚜𝚝 𝚛𝚊𝚝𝚎 𝚌𝚞𝚛𝚛𝚎𝚗𝚌𝚒𝚎𝚜 𝚘𝚛 𝚑𝚒𝚐𝚑-𝚍𝚒𝚟𝚒𝚍𝚎𝚗𝚍 𝚜𝚝𝚘𝚌𝚔𝚜. 𝚅𝚊𝚕𝚞𝚎 𝚏𝚘𝚌𝚞𝚜𝚎𝚜 𝚘𝚗 𝚒𝚗𝚟𝚎𝚜𝚝𝚒𝚗𝚐 𝚒𝚗 𝚞𝚗𝚍𝚎𝚛𝚟𝚊𝚕𝚞𝚎𝚍 𝚊𝚜𝚜𝚎𝚝𝚜—𝚎𝚜𝚜𝚎𝚗𝚝𝚒𝚊𝚕𝚕𝚢 𝚋𝚞𝚢𝚒𝚗𝚐 𝚠𝚑𝚊𝚝’𝚜 “𝚌𝚑𝚎𝚊𝚙” 𝚌𝚘𝚖𝚙𝚊𝚛𝚎𝚍 𝚝𝚘 𝚏𝚞𝚗𝚍𝚊𝚖𝚎𝚗𝚝𝚊𝚕 𝚖𝚎𝚝𝚛𝚒𝚌𝚜 𝚕𝚒𝚔𝚎 𝚎𝚊𝚛𝚗𝚒𝚗𝚐𝚜 𝚘𝚛 𝚋𝚘𝚘𝚔 𝚟𝚊𝚕𝚞𝚎. 𝙱𝚢 𝚒𝚜𝚘𝚕𝚊𝚝𝚒𝚗𝚐 𝚝𝚑𝚎𝚜𝚎 𝚏𝚊𝚌𝚝𝚘𝚛𝚜, 𝙰𝚁𝙿 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚒𝚎𝚜 𝚊𝚒𝚖 𝚝𝚘 𝚍𝚎𝚕𝚒𝚟𝚎𝚛 𝚍𝚒𝚟𝚎𝚛𝚜𝚒𝚏𝚒𝚎𝚍 𝚊𝚗𝚍 𝚞𝚗𝚌𝚘𝚛𝚛𝚎𝚕𝚊𝚝𝚎𝚍 𝚛𝚎𝚝𝚞𝚛𝚗𝚜.

𝙼𝚊𝚗𝚊𝚐𝚎𝚍 𝚏𝚞𝚝𝚞𝚛𝚎𝚜 𝚊𝚛𝚎 𝚊𝚕𝚕 𝚊𝚋𝚘𝚞𝚝 𝚏𝚘𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚝𝚛𝚎𝚗𝚍𝚜. 𝚆𝚑𝚎𝚝𝚑𝚎𝚛 𝚖𝚊𝚛𝚔𝚎𝚝𝚜 𝚊𝚛𝚎 𝚌𝚕𝚒𝚖𝚋𝚒𝚗𝚐 𝚘𝚛 𝚝𝚊𝚗𝚔𝚒𝚗𝚐, 𝚝𝚑𝚎𝚜𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚒𝚎𝚜 𝚞𝚜𝚎 𝚏𝚞𝚝𝚞𝚛𝚎𝚜 𝚌𝚘𝚗𝚝𝚛𝚊𝚌𝚝𝚜 𝚝𝚘 𝚌𝚊𝚙𝚒𝚝𝚊𝚕𝚒𝚣𝚎 𝚘𝚗 𝚖𝚘𝚖𝚎𝚗𝚝𝚞𝚖. 𝚃𝚑𝚎𝚢 𝚊𝚛𝚎𝚗’𝚝 𝚕𝚒𝚖𝚒𝚝𝚎𝚍 𝚝𝚘 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚊𝚜𝚜𝚎𝚝 𝚌𝚕𝚊𝚜𝚜 𝚎𝚒𝚝𝚑𝚎𝚛—𝚖𝚊𝚗𝚊𝚐𝚎𝚍 𝚏𝚞𝚝𝚞𝚛𝚎𝚜 𝚌𝚘𝚟𝚎𝚛 𝚊 𝚠𝚒𝚍𝚎 𝚛𝚊𝚗𝚐𝚎, 𝚒𝚗𝚌𝚕𝚞𝚍𝚒𝚗𝚐 𝚜𝚝𝚘𝚌𝚔𝚜, 𝚋𝚘𝚗𝚍𝚜, 𝚌𝚞𝚛𝚛𝚎𝚗𝚌𝚒𝚎𝚜, 𝚊𝚗𝚍 𝚌𝚘𝚖𝚖𝚘𝚍𝚒𝚝𝚒𝚎𝚜. 𝙻𝚎𝚟𝚎𝚛𝚊𝚐𝚎 𝚙𝚕𝚊𝚢𝚜 𝚊 𝚙𝚒𝚟𝚘𝚝𝚊𝚕 𝚛𝚘𝚕𝚎 𝚒𝚗 𝚝𝚑𝚎𝚜𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚒𝚎𝚜, 𝚊𝚖𝚙𝚕𝚒𝚏𝚢𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚎𝚡𝚙𝚘𝚜𝚞𝚛𝚎 𝚊𝚗𝚍 𝚎𝚗𝚑𝚊𝚗𝚌𝚒𝚗𝚐 𝚙𝚘𝚝𝚎𝚗𝚝𝚒𝚊𝚕 𝚛𝚎𝚝𝚞𝚛𝚗𝚜.

𝙵𝚘𝚛 𝚜𝚘𝚙𝚑𝚒𝚜𝚝𝚒𝚌𝚊𝚝𝚎𝚍 𝚒𝚗𝚟𝚎𝚜𝚝𝚘𝚛𝚜, 𝚕𝚒𝚚𝚞𝚒𝚍 𝚊𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚒𝚎𝚜 𝚕𝚒𝚔𝚎 𝚖𝚊𝚗𝚊𝚐𝚎𝚍 𝚏𝚞𝚝𝚞𝚛𝚎𝚜 𝚌𝚊𝚗 𝚙𝚛𝚘𝚟𝚒𝚍𝚎 𝚞𝚗𝚌𝚘𝚛𝚛𝚎𝚕𝚊𝚝𝚎𝚍 𝚛𝚎𝚝𝚞𝚛𝚗𝚜. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚝𝚑𝚎𝚜𝚎 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚒𝚎𝚜 𝚌𝚘𝚖𝚎 𝚠𝚒𝚝𝚑 𝚌𝚘𝚖𝚙𝚕𝚎𝚡𝚒𝚝𝚒𝚎𝚜 𝚝𝚑𝚊𝚝 𝚛𝚎𝚚𝚞𝚒𝚛𝚎 𝚌𝚊𝚛𝚎𝚏𝚞𝚕 𝚗𝚊𝚟𝚒𝚐𝚊𝚝𝚒𝚘𝚗. 𝙻𝚎𝚟𝚎𝚛𝚊𝚐𝚎, 𝚠𝚑𝚒𝚕𝚎 𝚌𝚊𝚙𝚊𝚋𝚕𝚎 𝚘𝚏 𝚜𝚞𝚙𝚎𝚛𝚌𝚑𝚊𝚛𝚐𝚒𝚗𝚐 𝚛𝚎𝚝𝚞𝚛𝚗𝚜, 𝚌𝚊𝚗 𝚊𝚕𝚜𝚘 𝚖𝚊𝚐𝚗𝚒𝚏𝚢 𝚕𝚘𝚜𝚜𝚎𝚜 𝚠𝚑𝚎𝚗 𝚖𝚊𝚛𝚔𝚎𝚝𝚜 𝚝𝚞𝚛𝚗 𝚞𝚗𝚏𝚊𝚟𝚘𝚛𝚊𝚋𝚕𝚎. 𝙰𝚜 𝚜𝚞𝚌𝚑, 𝚒𝚗𝚟𝚎𝚜𝚝𝚘𝚛𝚜 𝚖𝚞𝚜𝚝 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚝𝚑𝚎𝚜𝚎 𝚝𝚘𝚘𝚕𝚜 𝚠𝚒𝚝𝚑 𝚊 𝚌𝚕𝚎𝚊𝚛 𝚞𝚗𝚍𝚎𝚛𝚜𝚝𝚊𝚗𝚍𝚒𝚗𝚐 𝚘𝚏 𝚝𝚑𝚎 𝚛𝚒𝚜𝚔𝚜 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚍 𝚊𝚗𝚍 𝚎𝚗𝚜𝚞𝚛𝚎 𝚝𝚑𝚎𝚢 𝚊𝚕𝚒𝚐𝚗 𝚠𝚒𝚝𝚑 𝚝𝚑𝚎𝚒𝚛 𝚏𝚒𝚗𝚊𝚗𝚌𝚒𝚊𝚕 𝚐𝚘𝚊𝚕𝚜 𝚊𝚗𝚍 𝚛𝚒𝚜𝚔 𝚝𝚘𝚕𝚎𝚛𝚊𝚗𝚌𝚎.

Informative Paper To Learn More: https://www.spglobal.com/spdji/en/documents/education/education-indexing-liquid-alternatives.pdf

Navigating the Next Decade: Investment Strategies For Current Market Realities

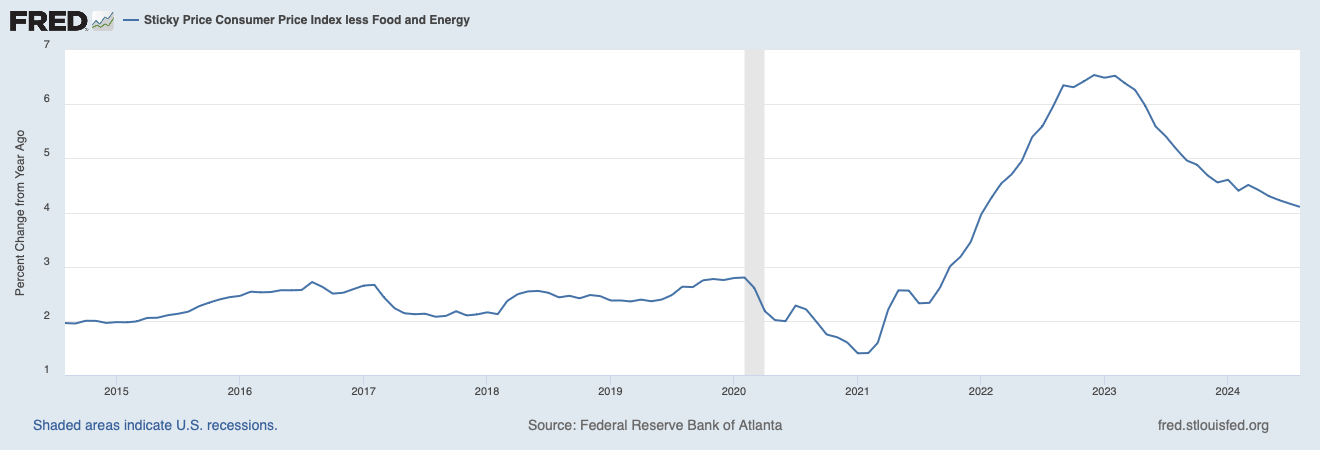

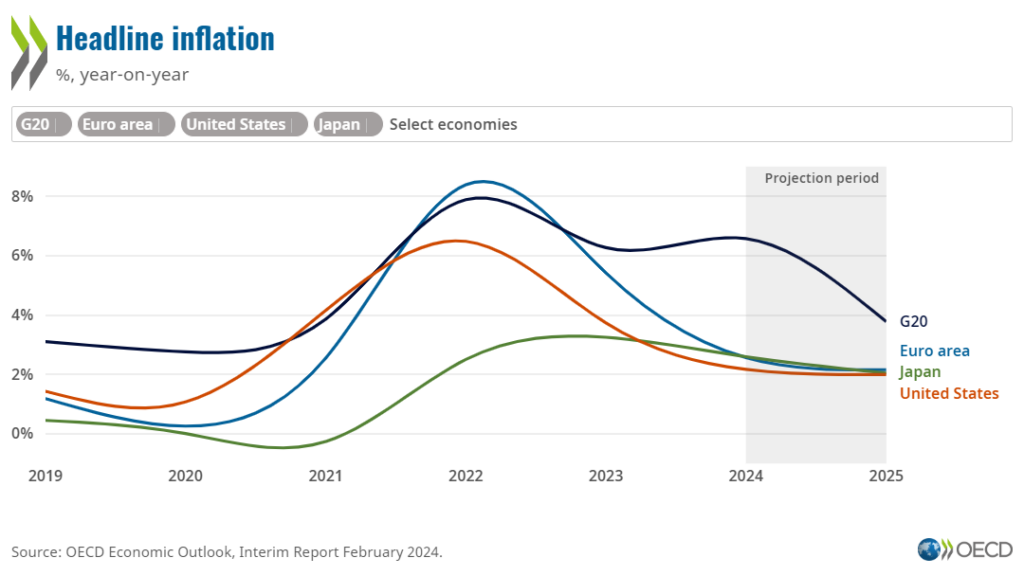

The first quarter of 2024 mirrored the trends seen in 2023, with a notable upswing in the US stock market and a corresponding decline in inflation concerns. However, despite the recent market rally amid decreasing inflation, lingering macroeconomic uncertainties continue to challenge equities. Amidst the possibility of intermittent inflation risks, it’s crucial to adopt a cautious yet proactive investment approach, as inflationary environments can lead to concurrent losses in both stocks and bonds, as observed in 2022.

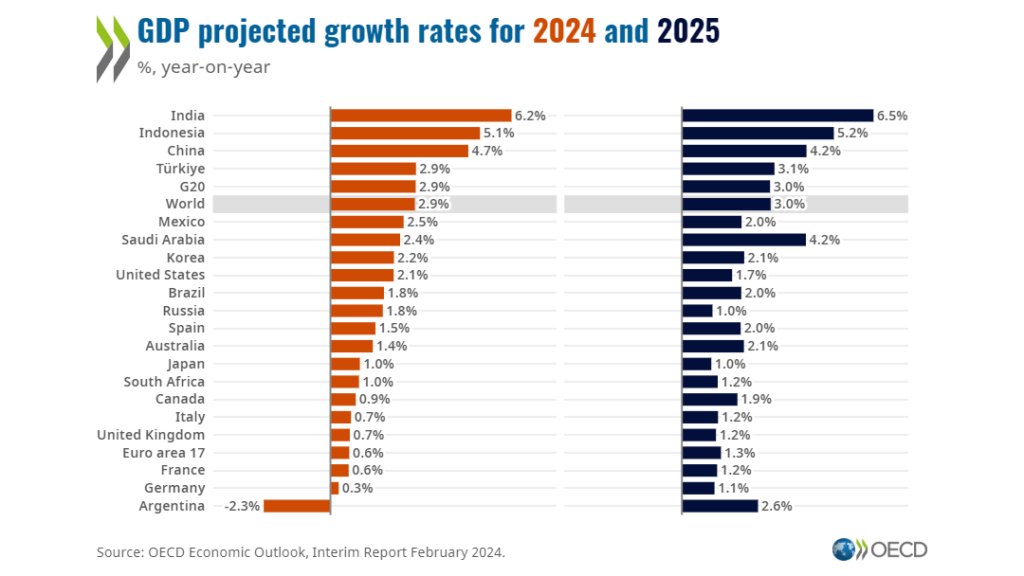

In navigating these dynamics, a prudent investment strategy must prioritize delivering positive long-term returns while ensuring resilience during market downturns to protect portfolios from erosion. One option involves focusing on inflation-protected assets and stocks of companies with robust pricing power, capable of weathering economic fluctuations. Furthermore, alongside inflationary worries, the rapid expansion of US markets has heightened their prominence globally, reducing the diversification potential of global equity indices.

Considering the US’s dominance in the MSCI All Country World Index and the concentration of US large-cap stocks reaching a peak in Q1 2024, it’s essential to evaluate the dispersion (valuation, capitalization, growth and so on) between geographies when constructing a diversified portfolio. Additionally, incorporating the expected inflation of major global geographies into investment strategies can provide valuable insights for crafting a resilient portfolio. Overall, successful investment planning for the next decade necessitates a diversified approach. Regular monitoring and adjustment based on prevailing economic conditions are vital for ensuring long-term investment success and resilience in the face of market uncertainties.

How much to “reserve”?

The work carried out by non-profits at both grassroots and higher levels holds great importance in shaping our changing world. We are deeply honored to support these organizations in their growth and assist in establishing a strong financial foundation. In this issue, we delve into a critical aspect of non-profit management: “Charting a course through the financial seas“.

As reported by urban.org, the United States is home to approximately 1.8 million non-profit organizations, encompassing public charities, private foundations, and various other entities. Of these, 501(c)(3) non-profits constitute approximately 75% of the sector and account for an estimated expenditure of around $1.94 trillion.

Data from urban.org indicates significant impacts on nonprofits in 2020, from the COVID-19 pandemic, with about 40% reporting decreased total revenue and an average reduction of 31% in revenue and 7% in paid staff.Read more…

Can non-profits self- manage investments, and when should they seek advisors?

Non-profit organizations often enlist the services of external advisors when decision making requirements surpass their in-house expertise. Two key facets warrant careful consideration. Advisors often offer insightful perspectives and also craft robust strategies aimed at safeguarding the organization’s long-term financial stability Next is mission alignment. Advisors can help harmonize investment strategies with the organization’s overarching values. Read More …

Can a non-profits “Theory of Change” map to investments?

The “theory of change” is a critical framework that non-profit organizations use to articulate their long-term goals, define their strategies, and measure their impact. It provides a structured roadmap for how an organization intends to create meaningful and sustainable change in the world. Is it essential to align this theory of change with investments that the organization makes? Read More …

The Allure of “Privates”

In the evolving world of investments, private strategies have garnered significant attention, attracting investors of all sizes with their promise of exclusivity and potential returns. At the heart of this landscape stands the Yale Model, celebrated for their leadership in alternatives and superior track record. Could smaller investment funds benefit from investing in private markets? Read more…