SUSTAINABLE INVESTMENT PARTNERS LLC

About the Firm ...

Being intentional. Being future-focused, while acknowledging current realities. Sustainable Investment Partners LLC (SIP) empowers clients to reach their investment goals with confidence.

Institutional Services:

Non-profits, foundations, and endowments find dedicated support for their investment journeys here. Crafting Investment Policy Statements and customized strategies, each solution aligns with unique goals, risk tolerance, and timelines.. Read more about Institutional Services here.

Wealth Services:

Personalized strategies align with individual and family goals and values. With a focus on creating a smooth path to financial success, pursue financial dreams with confidence. Read more about Wealth Services here

What You Can Expect:

- Expert Guidance: Founded by Anu Rames, an investment professional with two decades of investment expertise

- Customized Investment Strategies: Tailored to meet client goals, risk tolerance, and timeframes.

- Commitment to Client Values: Bespoke solutions integrating client values

- Focus on the Long-Term: Focused on long-term financial growth.

Check out the Perspectives page, where viewpoints are occasionally highlighted to spark discussions. Your input is valued, and your thoughts are always welcome.

INVESTMENT & NON-PROFIT PERSPECTIVES

𝙒𝙝𝙚𝙣 𝙩𝙝𝙚 𝙁𝙚𝙙𝙚𝙧𝙖𝙡 𝙍𝙚𝙨𝙚𝙧𝙫𝙚 (𝙁𝙚𝙙) 𝙙𝙚𝙘𝙞𝙙𝙚𝙨 𝙩𝙤 𝙘𝙪𝙩 𝙞𝙣𝙩𝙚𝙧𝙚𝙨𝙩 𝙧𝙖𝙩𝙚𝙨, 𝙞𝙩 𝙤𝙛𝙩𝙚𝙣 𝙨𝙥𝙖𝙧𝙠𝙨 𝙖 𝙡𝙤𝙩 𝙤𝙛 𝙚𝙭𝙘𝙞𝙩𝙚𝙢𝙚𝙣𝙩 𝙖𝙣𝙙 𝙨𝙥𝙚𝙘𝙪𝙡𝙖𝙩𝙞𝙤𝙣 𝙞𝙣 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙢𝙖𝙧𝙠𝙚𝙩𝙨. 𝘽𝙪𝙩 𝙬𝙝𝙖𝙩 𝙚𝙭𝙖𝙘𝙩𝙡𝙮 𝙙𝙤𝙚𝙨 𝙩𝙝𝙞𝙨 𝙢𝙤𝙫𝙚 𝙨𝙞𝙜𝙣𝙞𝙛𝙮, 𝙖𝙣𝙙 𝙬𝙝𝙖𝙩 𝙖𝙧𝙚 𝙞𝙩𝙨 𝙥𝙤𝙩𝙚𝙣𝙩𝙞𝙖𝙡 𝙞𝙢𝙥𝙡𝙞𝙘𝙖𝙩𝙞𝙤𝙣𝙨?

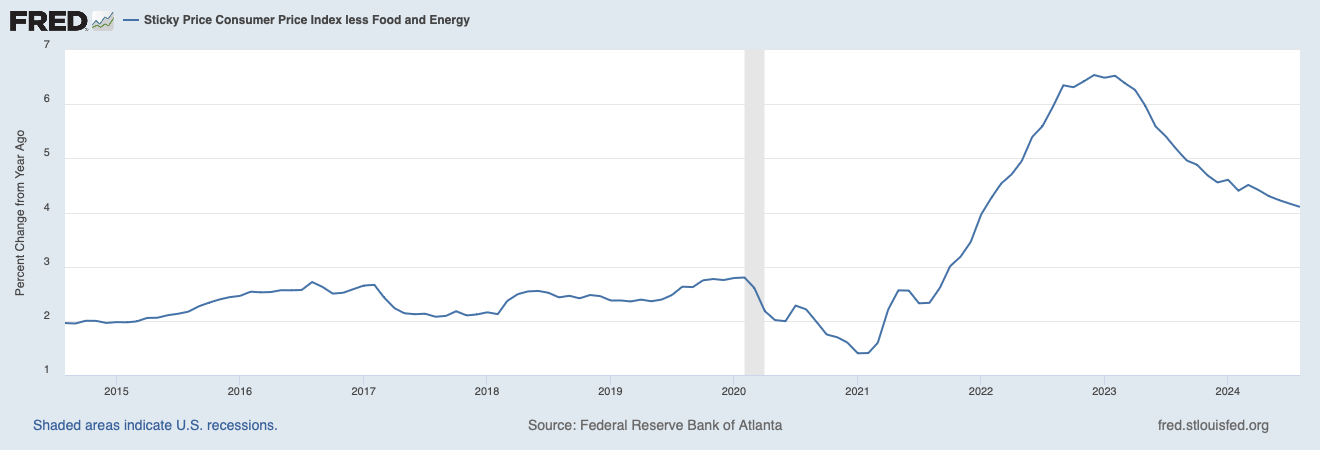

After a bout of inflation, when prices have risen substantially over a period, a rate cut could indicate that inflation has begun to slow down. However, the context in which the Fed makes such a decision is critical to understanding its true impact. Interest rates play a vital role in the economy by influencing borrowing costs for consumers and businesses. Lower interest rates make it cheaper to borrow money, which can lead to more spending and investment. In a healthy economy, this can spur growth. But if the economy is already showing signs of slowing, a rate cut might be a way to prevent it from falling into a recession. Read more here…

What Are Liquid Alts?

Liquid alternative strategies often come up in discussions among investors, especially given they can now be accessed via publicly traded ETF’s. So, what exactly are they, and what is their role in portfolios?

Let’s start with something familiar: the 60/40 portfolio—a mix of 60% stocks and 40% bonds. For years, touted as a reliable strategy for balancing risk and return. But here’s the problem: when markets crash, the average investor faces a gut-wrenching dilemma. When you watch your portfolio drop, it’s human nature to panic, and it takes an almost superhuman effort not to pull your money out. This brings up the idea of “downside-protected returns,” or investments that aim to grow while softening the blow during market downturns. Among the options, three approaches—Risk Parity, Alternative Risk Premia (ARP), and Managed Futures have publicly traded instruments available. Read More here

SUSTAINABILITY PERSPECTIVES

Global Events vs. Local Consumption

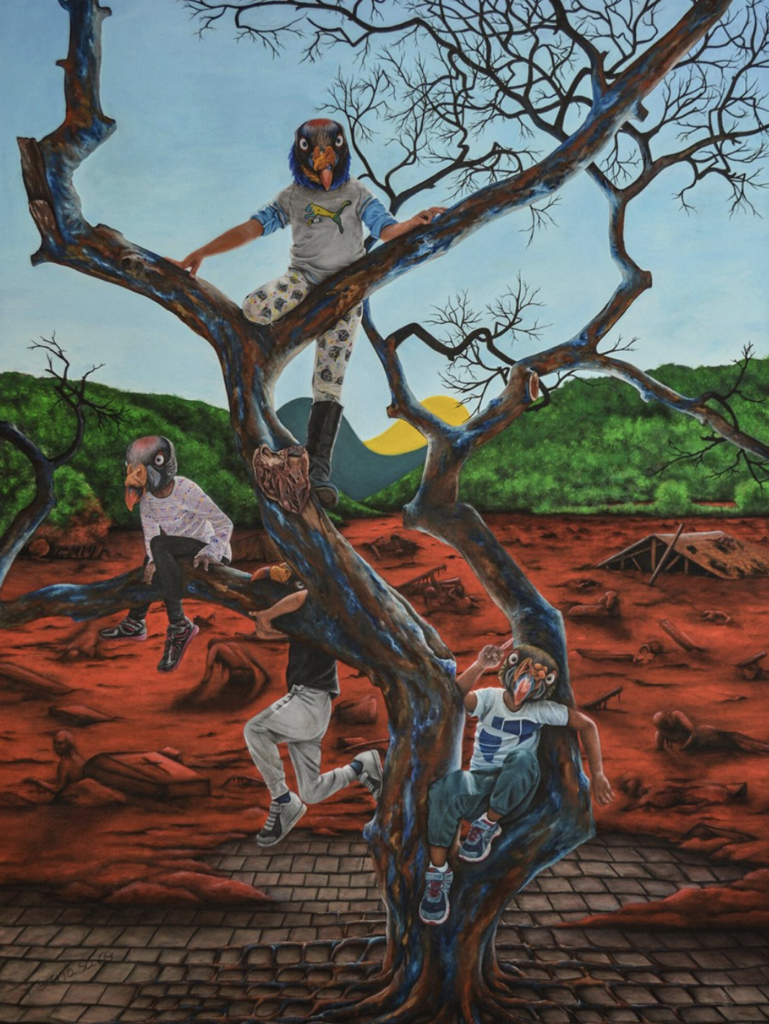

𝗙𝘂𝗻 𝗧𝗿𝗶𝘃𝗶𝗮: 𝗛𝗼𝘄 𝗜𝘀 𝘆𝗼𝘂𝗿 𝗰𝗼𝗼𝗸𝘄𝗮𝗿𝗲 𝗿𝗲𝗹𝗮𝘁𝗲𝗱 𝘁𝗼 𝗴𝗹𝗼𝗯𝗮𝗹 𝘁𝗿𝗮𝗱𝗲 𝗱𝘆𝗻𝗮𝗺𝗶𝗰𝘀? Often times, events occurring beyond national borders might seem unrelated to local interests at first glance. However, delving deeper into specific incidents allows us to uncover the connections. Take, for example, the global iron ore market. Iron ore plays a vital role in steel production, which is essential for constructing infrastructure, transportation systems, and machinery. Australia and Brazil, as major suppliers, account for over 70% of the world’s seaborne iron ore trade. Steel is the backbone of various industries, from household appliances to defense systems, shaping the foundation of modern society and its economic well-being. The evocative artwork “Brumadinho,” crafted by artist Fornasaro, powerfully portrays the impact of a devastating iron-ore mining incident in 2019. Read more here…

Our Connection to Waste …

In the modern era, our relentless pursuit of convenience has led to a pressing issue of waste management. From the widespread use of single-use plastics to the continuous cycle of disposable electronics, our daily routines contribute to a complex web of discard. Each discarded item symbolizes our collective oversight, resulting in the rapid expansion of landfills, the degradation of oceans, and a significant toll on wildlife. Read More here..

Welcoming Your Thoughts …

Email us

Your voice enriches this journey

Your perspectives, invaluable

Share your thoughts …

About

Anu Rames, Managing Principal & Founder, is a seasoned investor with two decades of investing expertise. Having worked at renowned global asset managers and Fortune 500 asset owners like BNP Paribas Asset Management, Liberty Mutual Investments, and Boston Trust Walden, Anu excels in partnering with investment committees of endowments/foundations, as well as sustainability-focused family offices and individuals, helping align their investment portfolios with their guiding principles. From 2017-19, she served as a member of the Investment Committee of the Liberty Mutual 401k Plan, representing over 72,000 plan participants.

Anu Rames holds a Master’s in Business Administration from Babson College in MA, USA. Prior to her MBA, she completed a Bachelor’s degree in Electrical & Electronics Engineering with a concentration in Power Systems at Calicut University, India

Contact

Please feel free to email, or use the contact form to get in touch.

Call:

+1-508-251-9421